Let’s be honest — not every part of running a freelancing business is fun.

There are some tedious, headache-inducing tasks that come with running a business that are simply unavoidable…like bookkeeping.

Keeping track of all business-related income and expenses can be tricky while balancing all of the other responsibilities of maintaining a freelance career, but luckily there are plenty of tools to help.

There is a wide variety of accounting software tools available to help you stay on top of your finances without much fuss. We’ve put together a guide laying out the best accounting software for freelancers with picks for every budget and need.

We’ve also compared some of the most popular programs side-by-side, so you can better understand what each of them does best and which one might be most suited to your needs. This makes it super easy to compare Freshbooks vs Quickbooks vs Wave and other top accounting programs.

Features to Look For When Choosing Accounting Software

There are a variety of features to look for when choosing the best bookkeeping software for your self-employed writing career.

Easy to Use

For one, you want to find an application that is easy to use.

You’ve got enough to worry about when juggling all of the obligations and responsibilities of a freelance writer, so you don’t need to spend hours learning accounting software.

Robust Invoicing Capabilities

Aside from ease of use, you’ll need freelancer accounting software that can easily keep track of and manage invoices.

If you’re billing multiple clients, make sure you’re using accounting software for freelancers that keeps track of multiple invoices.

Our favorite of the bunch is Freshbooks, which offers a wide range of freelancer invoicing tools including automatic reminders for overdue bills and a variety of methods through which your clients can pay you.

Freshbooks also has invoicing templates and customization options to make the entire process a breeze.

Plays Nice with Other Programs

Lastly, find accounting software that fits into your workflow and can integrate with your existing apps or tools.

Many accounting software packages offer mobile app integration with receipt capture and mileage tracking, or automatic quarterly tax calculations, for example.

With so many options to choose from, make sure you find right freelancer accounting software to fit your unique needs.

Our Picks for the Best Accounting Software for Self-Employed Freelancers

Best Overall Accounting Software for Freelancers: Freshbooks

Overall, our top pick for the best accounting software for self-employed writers is Freshbooks (free 30-day trial).

Freshbooks offers real-time invoice tracking, cloud support for seamless access from any device, automatic payment reminders for clients who don’t pay on time, multiple payment options, expense tracking, and, best of all, it’s easy to use.

Freshbooks requires a small subscription fee – $15/month for up to 5 clients or $25/month for up to 50 clients – but that fee ensures your books will be in the best hands possible. You can also get a discount by paying for an annual plan rather than month-to-month.

You can try FreshBooks free for 30 days to see if it’s the right choice for your freelance business.

If you’re weighing the decision between Freshbooks vs Quickbooks vs Wave or any of the other choices from our list of best free software, make sure you take a full look at the list of features each has to offer to decide which is best for you.

Best Free Accounting Software for Freelancers: Wave

If you’re like a lot of freelance writers, you don’t have hours each week to spend keeping track of your invoices, payments, and receipts.

You also likely don’t have hundreds of dollars to spend each year on a booking service.

Luckily, there are some free bookkeeping softwares available.

The best free accounting software we’ve found out there is Wave.

Wave offers a comprehensive suite of tools to track payments and expenses, manage your invoices, integrate payroll and tax record-keeping, and even scan receipts right from their mobile app.

So, what’s the catch?

As with anything that’s free, there will be some limitations.

The most common complaint about Wave is its customer support is very limited – email only, no phone or live chat, which can make it a major hassle to resolve any issues you might come across.

Wave also lacks some useful features like time tracking.

Best Accounting Software for TurboTax Users: Quickbooks Self-Employed

One of the most challenging parts of a freelance writing career is doing your self-employed taxes.

Unlike full-time jobs working for a single employer, a freelance writing career usually involves multiple sources of income without money for taxes being taken out automatically by employers or the IRS.

As such, freelance writers need accounting software that can integrate calculating and deducting a portion of your income for quarterly taxes.

If you’re like the millions of people who use TurboTax to do your taxes online, the best accounting software for self-employed writers we’ve found is QuickBooks Self-Employed.

This easy-to-use software can track mileage, sort expenses, organize receipts, send and manage invoices, and even estimate and file taxes.

QuickBooks Self-Employed requires a monthly subscription, but you’ll likely make that back on the deductions this full-featured software has to offer.

When it comes to Freshbooks vs QuickBooks Self-Employed, you’ll find the two apps offer a lot of the same features. Many users find Freshbooks to be simpler for single-employee business (like most freelance writers), while Quickbooks Self-Employed can help freelancers who work as part of a team. Take a look at the full features list for each to see which is best for you.

Best Accounting Software for Freelancers Needing Customization:

Bonsai

Another great solution out there is Bonsai (at HelloBonsai.com).

With it, you can quickly create invoices, handle time tracking, keep track of expenses, and clients. You can even customize with discounts, directly integrate everything to make taxes easier, and change your preferred payment methods globally or for each client.

Bonsai is fairly affordable at $24 per month on the low end. When you consider how much your time is worth as a freelancer and how much time this software can save you on the daily minutiae of keeping records and tracking with multiple clients, it seems to be well worth the investment.

Xero

If you like a highly customizable experience on whatever software you’re using whether it’s for bookkeeping or any other task, take a look at Xero.

Xero offers the option to automate many of the accounting tasks you do each month such as invoicing or generating reports. Xero also offers the ability to sync with a financial advisor, which makes decision-making much easier than going it alone.

One of the most unique features of Xero is its ability to integrate third-party apps.

Over 800 apps are available on the Xero app marketplace which offers users a huge variety of tools that add extra features and enhanced useability.

If you’re looking for a customizable experience that will make your bookkeeping and invoicing as seamless as possible, look no further than Xero.

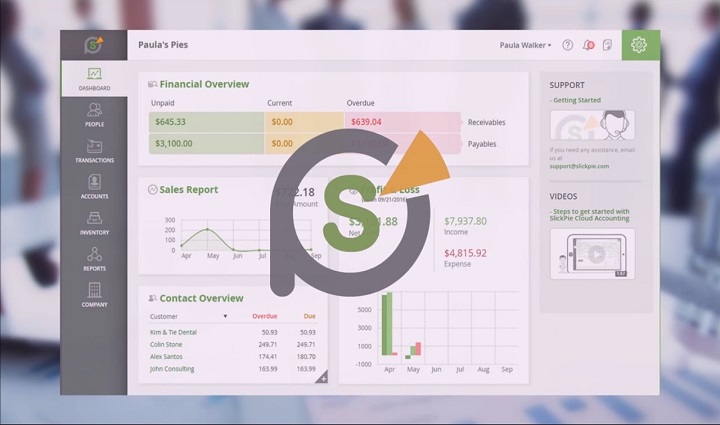

Best Accounting Software for Freelancers with International Clients: SlickPie

Today’s freelance writing world often involves working with clients or vendors from around the world.

While having an international workforce at your disposal can offer many benefits, it can create a significant headache in terms of bookkeeping due to different exchange rates, tax laws, security concerns, etc.

Luckily, free accounting software SlickPie offers multi-currency support, bank-grade security, and a variety of payment options that can make working with international clients much easier.

SlickPie has the ability to sync across multiple devices, a mobile app, and even lets users sync accounts with multiple users and accounts. Best of all, SlickPie offers world-class support to keep your bookkeeping running as smoothly as possible.

Get Back to Doing What You Love

The best accounting software for freelancers is the one that will save you time and energy so you can get back to doing the most important thing — making money writing.

Every single moment you spend managing your books is a moment you could be finding new clients or completing outstanding projects. So the more you can automate your bookkeeping process with software, the better.

Do you have a favorite accounting software for freelancers? Share your insight by commenting below.